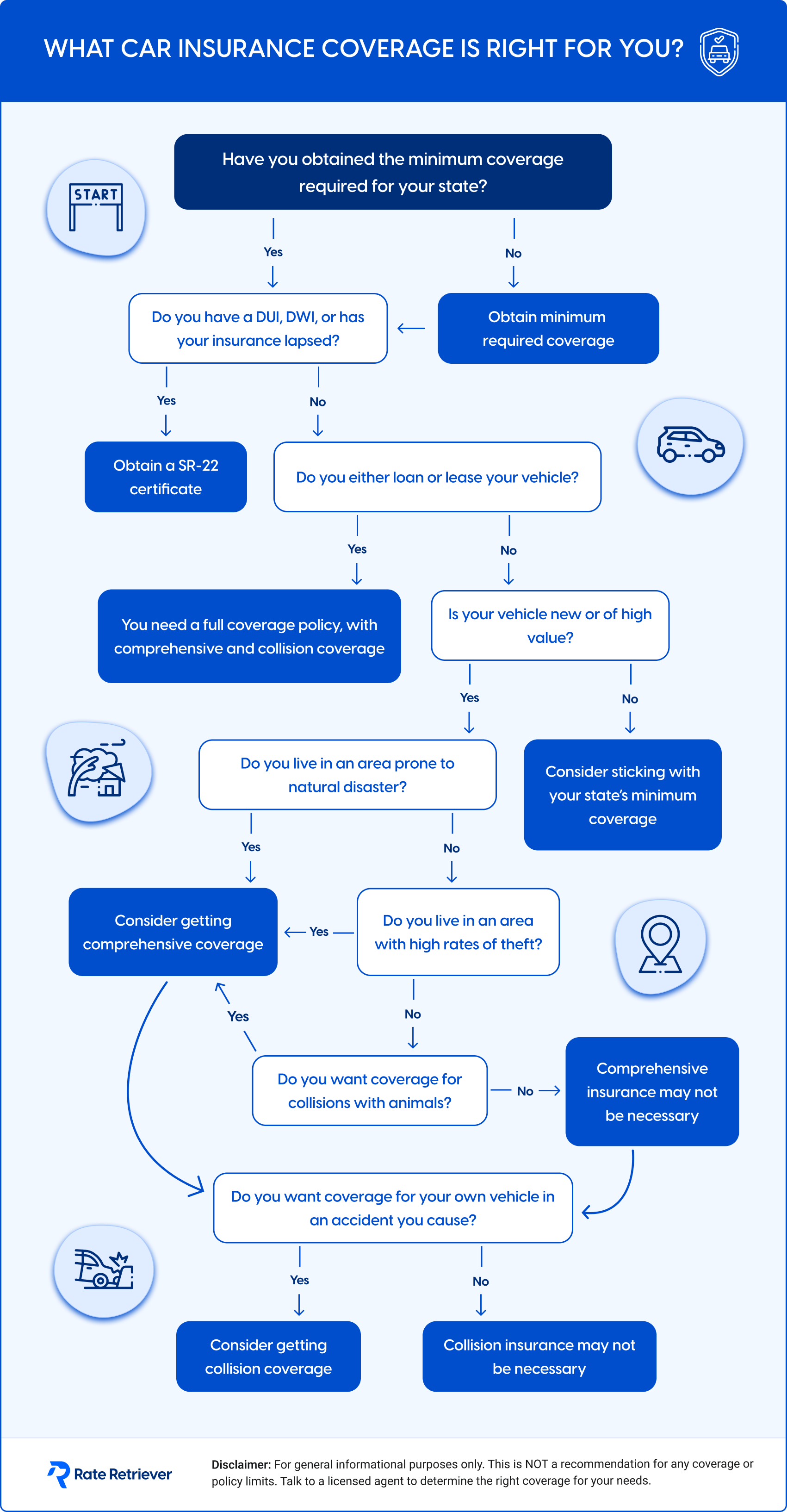

What types of coverage are available for car insurance?

There are different types of coverage available for car insurance, such as liability, which helps pay for damage you cause to others, and collision, which helps cover damage to your own car from accidents. Comprehensive coverage can help with other damages, like theft or natural disasters. Medical coverage can help with medical expenses for you or passengers. Some policies also offer uninsured motorist protection in case you’re in an accident with someone who doesn’t have insurance. It’s important to choose the right types of coverage based on your needs, budget, and state laws.