Yes, you should regularly review and adjust your coverage as your business evolves to ensure that all new risks are adequately covered.

Home » Car insurance » By State » Vermont

Cheap car insurance in Vermont 2024

- Car insurance costs $1,186 a year on average in Vermont

- Progressive, State Farm, and Concord Group Insurance are the cheapest car insurance companies

No phone or email required. Seriously.

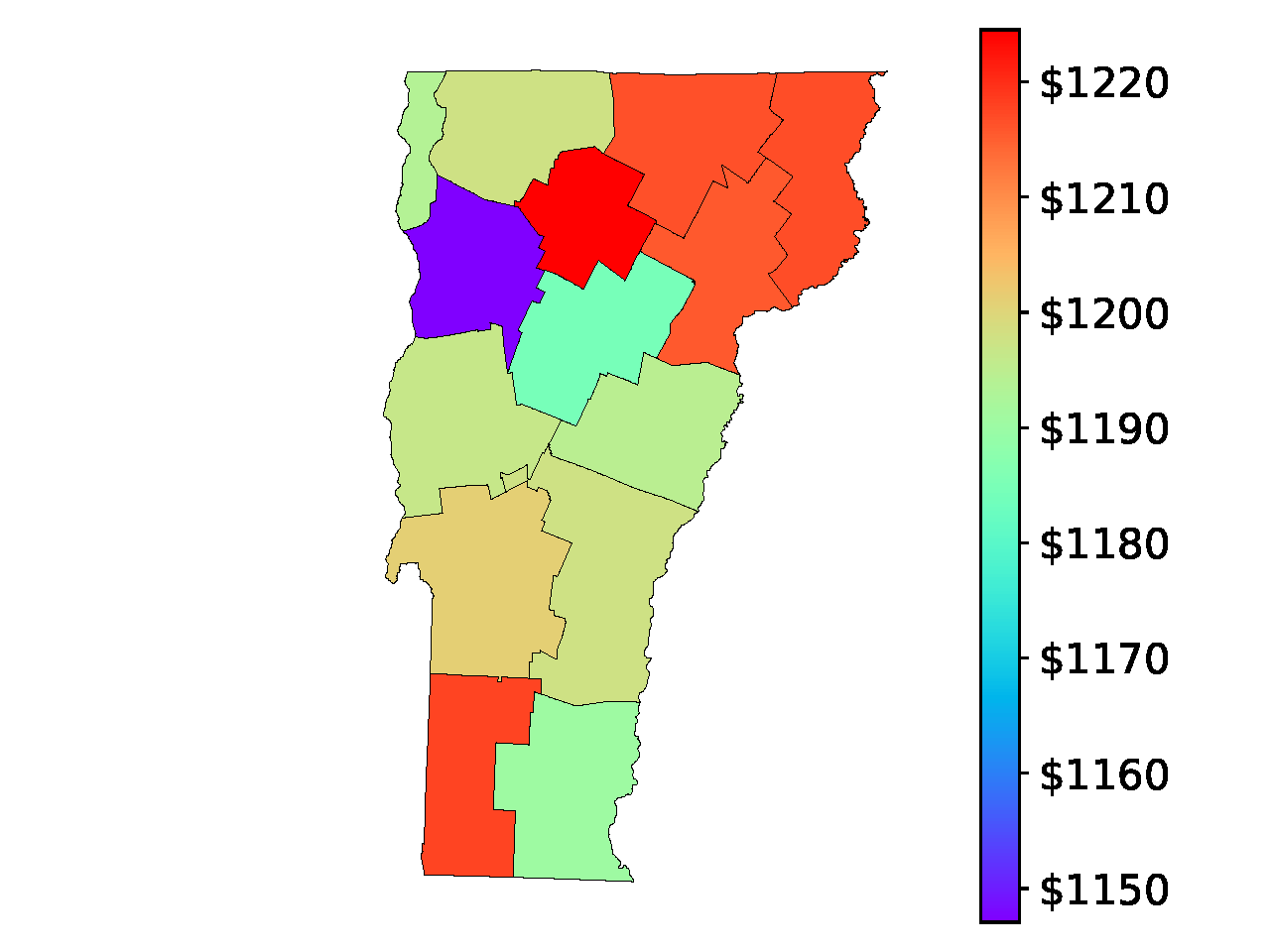

Average car insurance rates in VT by county