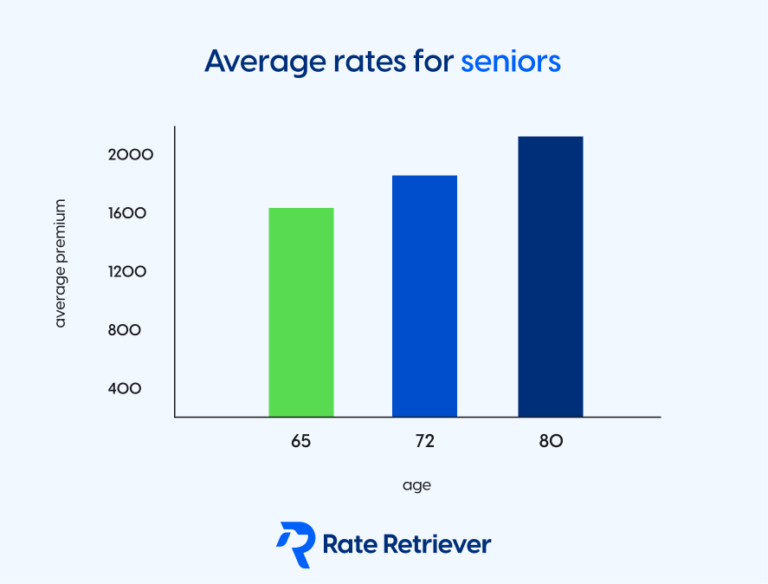

Data shows that senior drivers have a higher risk of being injured in a car accident and are more likely to cause accidents than younger drivers. Many age-related factors, such as loss of vision, motor skills and even some medical conditions can increase the likelihood of a crash.

As a result, car insurance companies often charge senior drivers higher rates to offset the increased risk of a claim. When shopping for the best car insurance for elderly drivers, its a good idea to get quotes from multiple carriers to see which provider can offer the lowest rate.a