Home » Car insurance » By State » Tennessee

Cheap car insurance in Tennessee

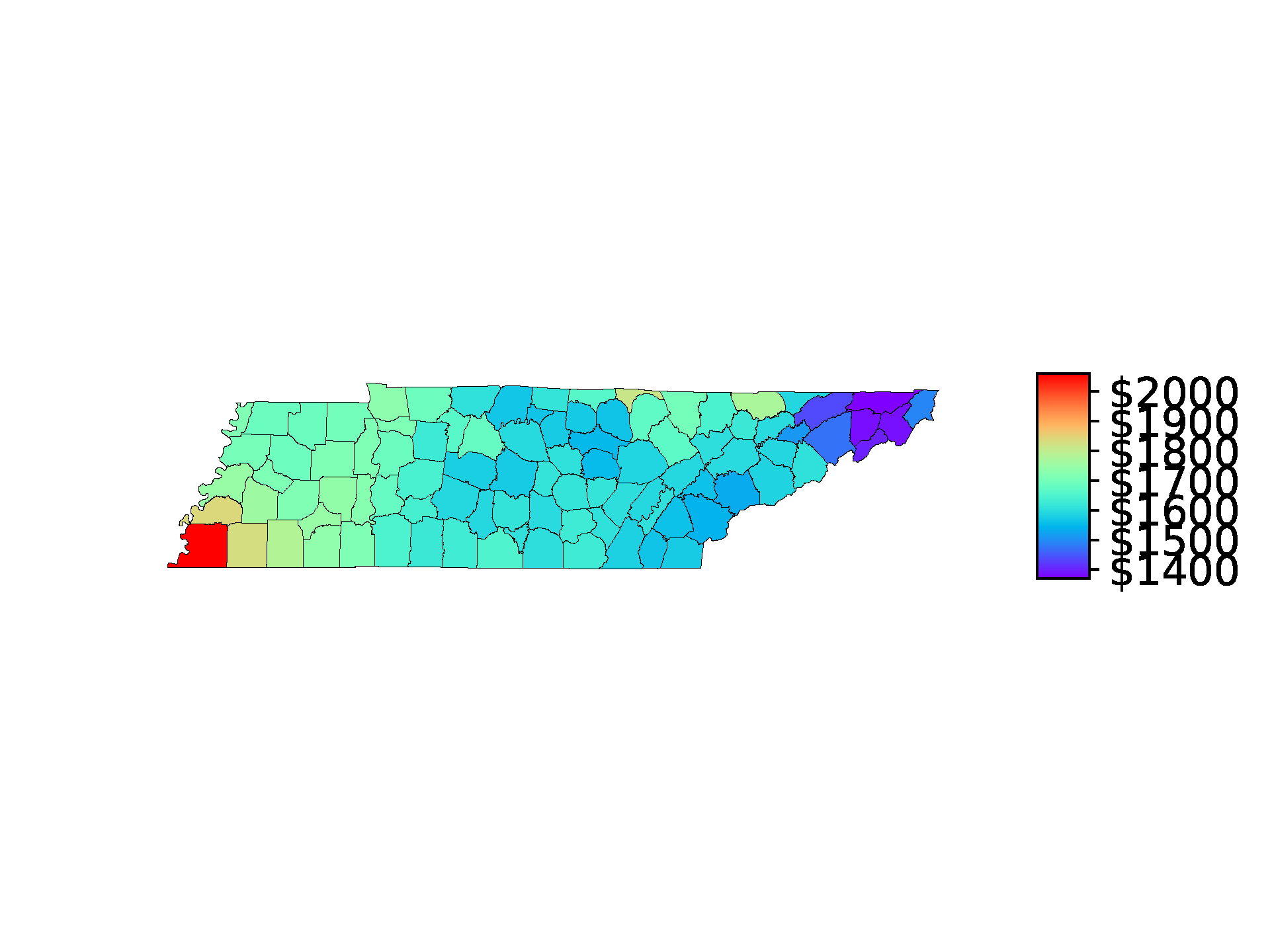

In Tennessee, the average cost of car insurance is $1,669 a year and State Farm, Auto-Owners, and Travelers are among the best and cheapest car insurance companies. You may find that another company is better for you based on your profile, vehicle, and coverage needs.

Fetch the best rates for the right coverage, no sign up required!

"*" indicates required fields