Call a licensed agent: 833-964-9663

All car insurance companies determine their rates differently based on the policy and the driver. By comparing auto insurance quotes from multiple companies, you can identify who offers cheap car insurance, discounts, and incentives that benefit you the most.

30 seconds. 214 insurance companies. No sign-up required.

No phone or email required

"*" indicates required fields

30 Seconds | No Sign-Up | Reliable Results

There are many ways to save money on car insurance. The first step is researching insurance providers and shopping around for a car insurance policy that offers the best coverage at the best price.

It’s important to ensure your policy isn’t just budget-friendly but also provides the amount of coverage you need.

Car insurance rates are personalized for every driver. But depending on factors like your location and driving record, car insurance premiums can be extremely expensive. There are many reasons why car insurance rates can be costly, but the good news is that car insurance rates often decrease with age, assuming you avoid accidents and claims.

Auto insurance companies offer cheaper car insurance to individuals who they consider “low risk.” There are many factors that may impact your rate including who you are, the state you live in, and the vehicle you drive. For example, individuals in their 40s who haven’t filed many insurance claims and have a good credit score will typically pay less than a teenage driver with little to no driving experience.

Some factors, like age and credit score, impact your rate more than others.1

Additionally, some states prohibit insurance companies from using certain factors to calculate their rates; for example, insurance companies cannot use credit history when determining rates for people who live in California, Hawaii, or Massachusetts.2

Below are some of the most common factors that impact your car insurance rate.

Perhaps the biggest factor in determining your car insurance rate is your location. Insurance costs differ state-by-state because each state has its own set of requirements for what and how much insurance you need. Your zip code will also factor into your final car insurance rate; if you live in a densely populated area or one with a high crime rate, you’ll likely pay more for insurance.

The type of coverage and limits will have a significant impact on the rates you pay for insurance. The minimum limits are determined by state. Insurance plans for the minimum coverage allowed by law are cheaper than if you want a full coverage plan, regardless of the provider.

Your demographic profile also impacts your car insurance rates. Insurance providers look at demographic information such as your age, gender, marital status, education level, credit score and more.

Year, make, model, and trim level all affect your car insurance rates. It all boils down to this: the more your car will cost to repair or replace, generally the more it will cost to insure. Vehicle safety features and your annual mileage may also impact your car insurance rate or help you qualify for discounts.

Incidents such as accidents, traffic violations, and past claims may impact your rate. However, the impact on your rate is typically proportionate to the severity of the incident (ie. those with DUIs are more expensive to insure than those with a minor parking violation).

Car insurance providers may also offer discounts for certain qualifying criteria. Common discounts you can look for to get cheaper car insurance include:

Each company has their own rating guidelines that determine how each of these factors impact the rates they provide. For example, while one company may use credit score as a strong indicator, another might not consider credit score as relevant as the number of years you’ve been insured continuously.

Because of this, your driver profile might be more attractive to some companies than others – and this is why you can receive cheaper rates depending on the car insurance company you choose. That’s why it’s so important to compare quotes from multiple companies to find the cheapest insurance available to you, based on your desired coverage amounts.

Start saving in 3 simple steps

Only tell us about factors that have the biggest impact on your rates. No phone number or email required

We match you with top insurance companies and estimate how much you’ll pay at each

Compare rates side-by-side to find the best rate for the right coverage

Car insurance costs vary by state. Some states offer cheaper car insurance than others because there is less insurance coverage required by law. For example, some states only require drivers to carry property damage liability and bodily injury liability. Other states require both property damage and bodily injury liability, along with uninsured motorist coverage, underinsured motorist coverage, and personal injury protection.

In general, the more coverage a state requires, the more expensive car insurance costs will be. Some of the states with the cheapest auto insurance policies are Wyoming, Vermont, Idaho, Maine, and Hawaii.

Discover how much auto insurance costs and where to find cheap car insurance in your state using the tool below.

Many of the nationally-known insurance companies, including Progressive, Liberty Mutual, Allstate, Geico, Travelers, and Farmers, offer competitive car insurance rates. However, these popular companies aren’t your only option when choosing the most affordable car insurance company. Local companies may provide more competitive rates and a positive customer service experience.

When searching for the best cheap car insurance company, it’s important to consider the company’s reputation and customer satisfaction as well as cost. The best company is affordable but also responsive, helpful, and fast to resolve issues and claims.

Compare the top auto insurance companies to find the car insurance company that will be best for you.

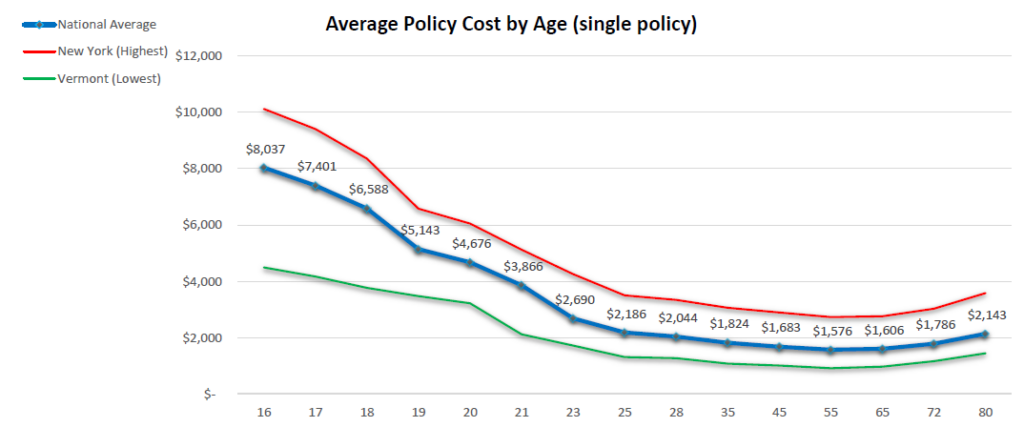

Age is a huge factor car insurance companies consider when it comes to determining an individual’s risk. In general, it is much easier for those between the ages of 40 and 50 to get cheap car insurance than a teen or young adult.

Teenagers pay the most for car insurance from the ages of 16 to 19 and see a significant decrease in cost once they reach age 25. After that, car insurance costs typically continue to decrease steadily. However, even though older drivers pay less for car insurance on average, other risk factors can impact an experienced driver’s insurance rate. Some insurance companies also offer discounts for new, teen, and young adult drivers to lower their overall cost.

Learn more about how age affects car insurance and where to find the most affordable car insurance by age.

Is car insurance cheaper if you’re married? Usually, the answer is yes! On average, married individuals pay less for their car insurance premiums than single or divorced individuals. This is because insurance companies may use marital status as a rating factor, and married individuals are generally less risky to insure.

While you do not have to be on the same insurance policy as your spouse, you may see significant savings if you combine your policies. This is because most insurance providers offer a discount for multi-vehicle policies.

| State | Male Policyholder | Female Policyholder | Combined Policy |

|---|---|---|---|

| Alabama | 1,674 | 1,648 | 1,586 |

| Alaska | 1,617 | 1,596 | 1,543 |

| Arizona | 1,799 | 1,768 | 1,683 |

| Arkansas | 1,914 | 1,886 | 1,761 |

| California | 1,923 | 1,923 | 1,746 |

| Colorado | 2,001 | 1,997 | 1,915 |

| Connecticut | 2,145 | 2,104 | 1,995 |

| Delaware | 2,398 | 2,392 | 2,172 |

| Florida | 2,627 | 2,695 | 2,447 |

| Georgia | 1,897 | 1,877 | 1,657 |

| Hawaii | 1,325 | 1,325 | 1,317 |

| Idaho | 1,190 | 1,167 | 1,108 |

| Illinois | 1,782 | 1,765 | 1,714 |

| Indiana | 1,483 | 1,477 | 1,424 |

| Iowa | 1,512 | 1,502 | 1,439 |

| Kansas | 1,919 | 1,917 | 1,865 |

| Kentucky | 2,102 | 2,080 | 1,871 |

| Louisiana | 3,129 | 3,057 | 2,844 |

| Maine | 1,286 | 1,253 | 1,165 |

| Maryland | 2,301 | 2,265 | 2,114 |

| Massachusetts | 1,648 | 1,648 | 1,620 |

| Michigan | 2,501 | 2,501 | 2,485 |

| Minnesota | 1,896 | 1,903 | 1,833 |

| Mississippi | 1,573 | 1,591 | 1,417 |

| Missouri | 2,221 | 2,183 | 1,949 |

| Montana | 1,556 | 1,547 | 1,491 |

| Nebraska | 1,794 | 1,798 | 1,673 |

| Nevada | 2,444 | 2,415 | 2,124 |

| New Hampshire | 1,421 | 1,439 | 1,353 |

| New Jersey | 2,360 | 2,318 | 2,260 |

| New Mexico | 1,622 | 1,611 | 1,586 |

| New York | 3,533 | 3,654 | 3,407 |

| North Carolina | 1,542 | 1,542 | 1,529 |

| North Dakota | 1,602 | 1,599 | 1,566 |

| Ohio | 1,294 | 1,274 | 1,194 |

| Oklahoma | 2,181 | 2,135 | 2,049 |

| Oregon | 1,564 | 1,603 | 1,547 |

| Pennsylvania | 2,015 | 2,015 | 1,825 |

| Rhode Island | 2,005 | 1,975 | 1,914 |

| South Carolina | 1,704 | 1,667 | 1,538 |

| South Dakota | 2,023 | 2,021 | 1,958 |

| Tennessee | 1,669 | 1,659 | 1,467 |

| Texas | 2,280 | 2,266 | 2,077 |

| Utah | 1,871 | 1,843 | 1,767 |

| Vermont | 1,186 | 1,153 | 1,123 |

| Virginia | 1,636 | 1,619 | 1,570 |

| Washington | 1,553 | 1,561 | 1,429 |

| Washington DC | 2,022 | 2,015 | 2,034 |

| West Virginia | 1,628 | 1,572 | 1,504 |

| Wisconsin | 1,472 | 1,471 | 1,446 |

| Wyoming | 1,172 | 1,187 | 1,188 |

Some of the cheapest insurance companies (on average) for married couples include Erie Insurance, Progressive, American Family, and Nationwide.

Your credit score can have a major impact on the price you pay for car insurance. While California, Hawaii, Maryland, Michigan, and Massachusetts prohibit or limit the use of credit-based insurance rating, in every other state you can usually expect to pay more – 73% more on average – for your insurance premiums if you have poor credit.

However, it’s still possible to find affordable insurance with a low credit score. Nationwide, American Family, and Progressive are among the national insurers who on average have cheaper rates for individuals with poor credit. Additionally, there are companies like The General, Dairyland, and National General that specialize in non-standard insurance and may offer more reasonable rates.

Learn more about getting car insurance if you have poor credit.

Buying a new car is a great time to reevaluate your car insurance to see if you can save on your premiums. New cars tend to cost more to insure than cars that are a few years old.

The best insurance for a new car is different for every driver, depending on where you live, how much coverage you want, and your budget, among other things. To make sure you’re getting the cheapest insurance for your situation, it’s a good idea to compare multiple insurance companies.

There are a number of reasons that someone may need to purchase a car insurance policy, even if they do not have a driver license. If your license has been suspended, you own a classic car, or members of your household are starting to drive, you may need to purchase a car insurance policy, even if you aren’t going to be the one driving.

Learn more about getting car insurance without a driver license.

If you are an educator, you may qualify for cheaper premiums at certain car insurance companies. There are two ways this can happen:

If you think you’re paying too much for your insurance, there are some ways to get cheaper car insurance.3 Here are some strategies that can help you find the best rates available to you:

Doing so will help you start out with the best rates for your driver profile. You can even show your current provider a quote from a different company to see if they can match it.

Many car insurance companies offer discounts for different qualifications such as good student discounts, defensive driving completion, active military or veteran status, and even loyalty discounts.

Some car insurance companies offer discounts for safe drivers and those who haven’t made a claim in some time.

Paying on time or setting up auto-pay will sometimes help lower your rate over time.

If you have a higher deductible, your premiums will be lower; however, be cautious doing this because in the event of an accident you will pay more out-of-pocket.

Cars that are at least five years old often cost less to insure, so when you’re shopping for a vehicle, consider buying used.4

Compare how much insurance costs at the top insurance companies near you

"*" indicates required fields

30 Seconds | No Sign-Up | Reliable Results

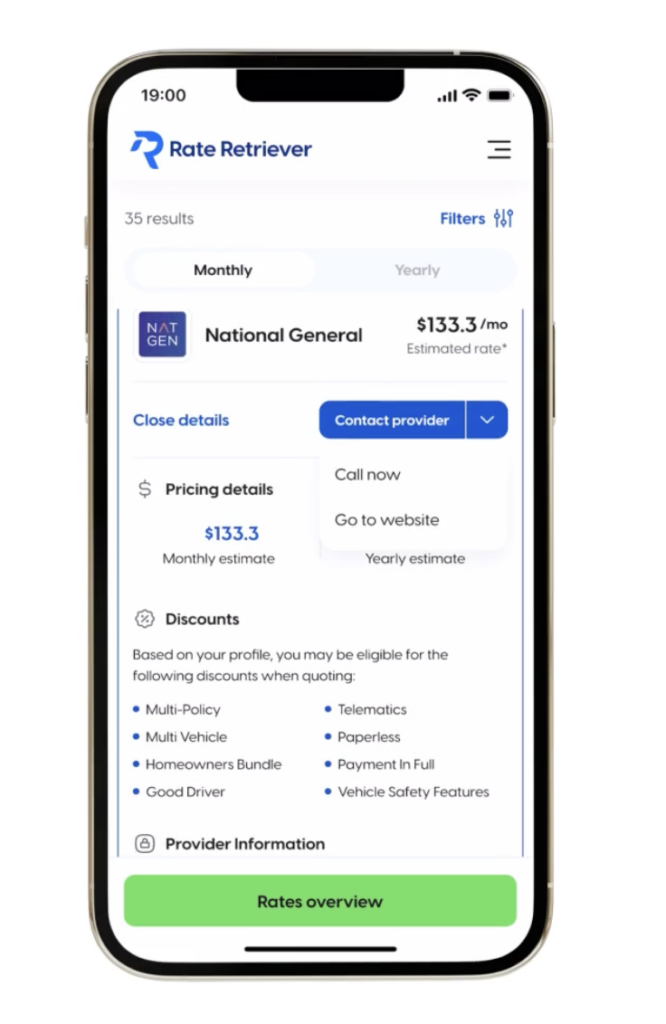

At Rate Retriever, our mission is to make the way you shop for insurance transparent and fair through user-friendly tools that respect your privacy and deliver reliable, comprehensive results.

So we took everything we hated about comparing insurance quotes online – the spam, the long questionnaires, the limited choices, the inaccuracy of quote prices – and threw it out the window, favoring a short form that more accurately estimates what you’ll pay at each of the top insurance providers near you.

Rate Retriever is an independent company that is not owned by an insurance provider, nor do we provide insurance ourselves. This independence allows us to be your free and impartial insurance research tool, helping you make the best decisions for your insurance needs.

We may earn a commission when you click one of the links or call one of the providers listed on our site; however, we do not allow our partnerships to influence which information we provide.

Dig up the best insurance providers in seconds

"*" indicates required fields

Copyright © Rate Retriever Insurance Services LLC, a wholly-owned subsidiary of Soleo Communications, Inc. 2024. All Rights Reserved. Use of Rate Retriever’s services is subject to our Privacy Policy, Disclaimer, and Terms and Conditions. Accessibility statement. Cookie policy. Do Not Sell My Personal Info.