Driving without insurance is illegal in WY. If you are convicted of driving without insurance, you will be subject to fines, license suspension, and even jail time.

Home » Car insurance » By State » Virginia

Cheap car insurance in Virginia 2024

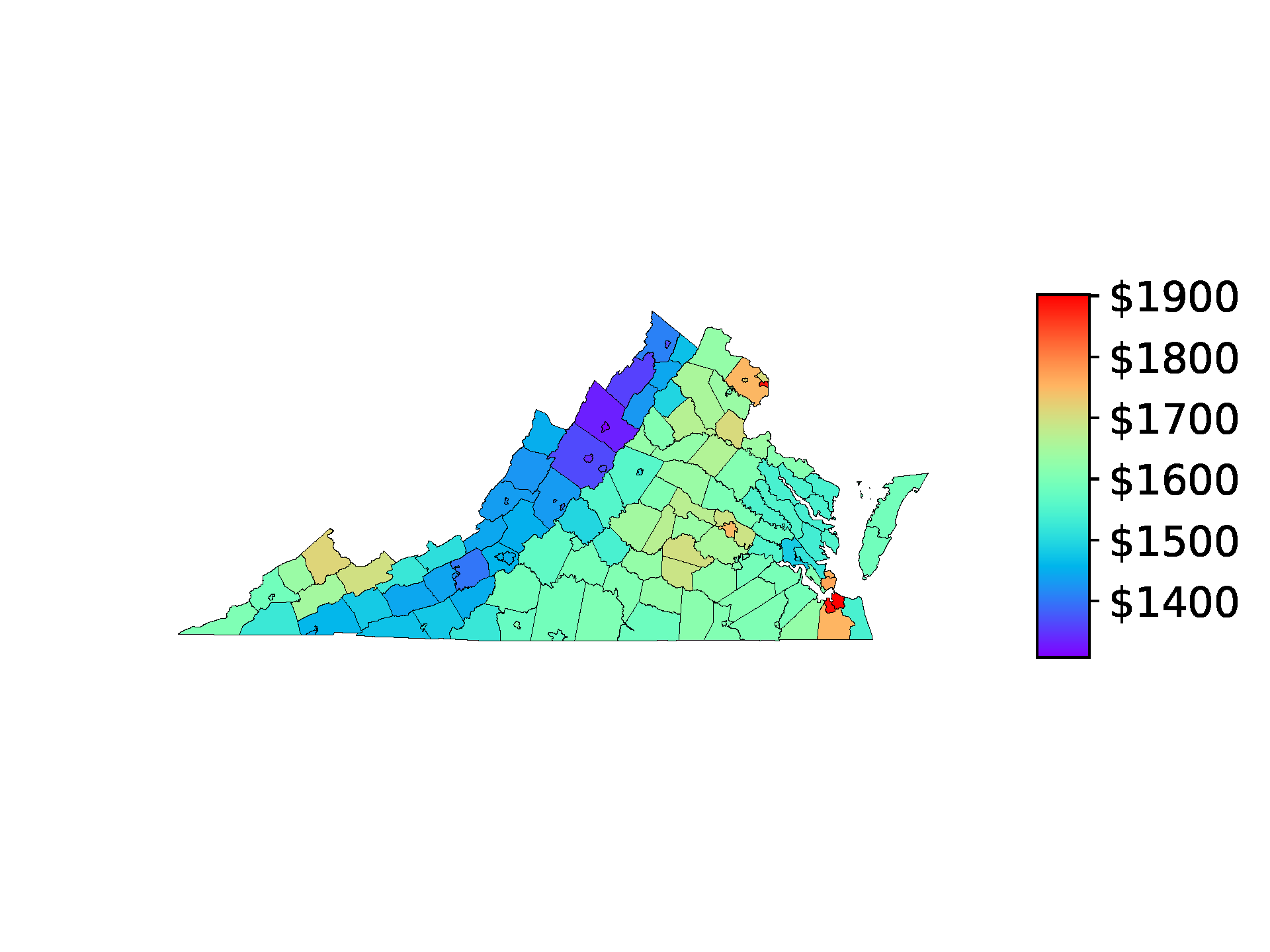

- Car insurance costs $1,636 a year on average in Virginia

- Nationwide, Farm Bureau Insurance Virginia, and Travelers are the cheapest car insurance companies

No phone or email required. Seriously.

Average car insurance rates in VA by county