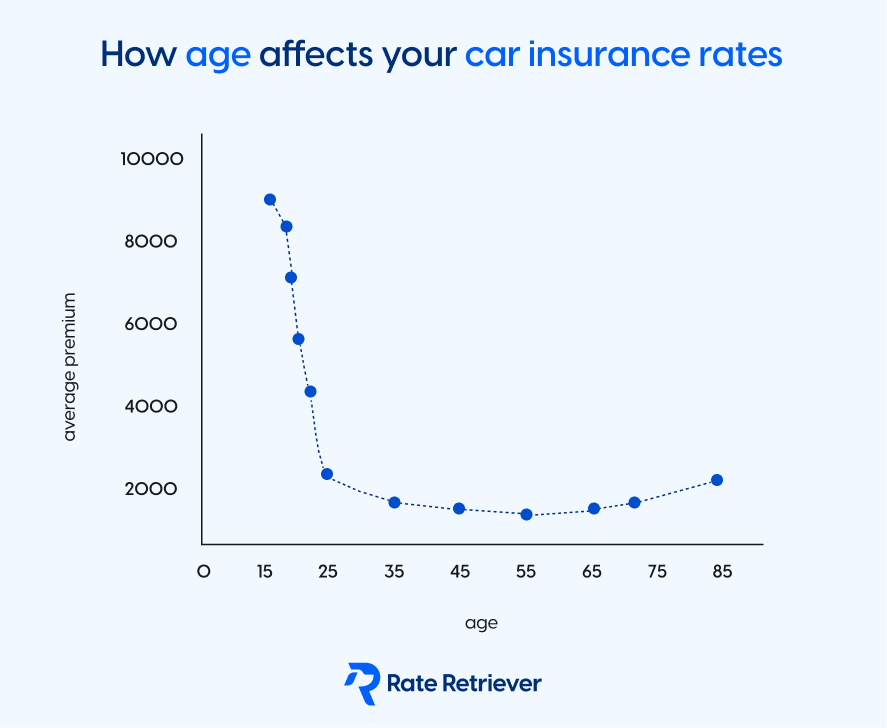

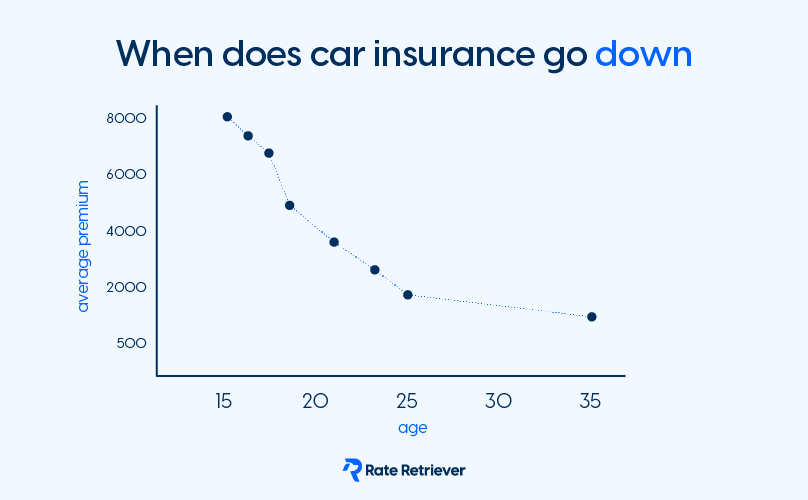

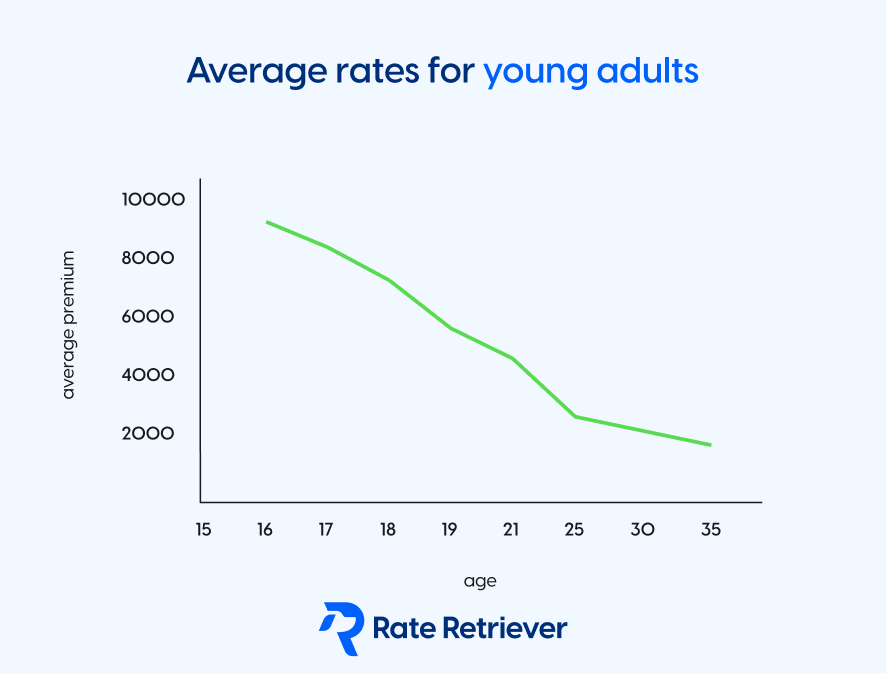

Generally, car insurance rates can go down as you get older. This is because older drivers tend to have more experience on the road and are considered to be less risky to insure. As you age, you may also qualify for additional discounts or benefits from insurance companies. However, other factors such as your driving record, the type of car you drive, and where you live can also impact your rates. It’s important to regularly review your policy and shop around for the best rates to ensure you’re getting the best deal as you age.

Quick quiz

Only tell us about factors that have the biggest impact on your rates. No phone number or email required

Retrieve your rates

We match you with top insurance companies and estimate how much you’ll pay at each

Compare and save

Compare rates side-by-side to find the best rate for the right coverage