Call a licensed agent: 833-964-9663

See what you’ll pay at the top providers in your state – start comparing today

Enter your zip code to find coverage in your area

"*" indicates required fields

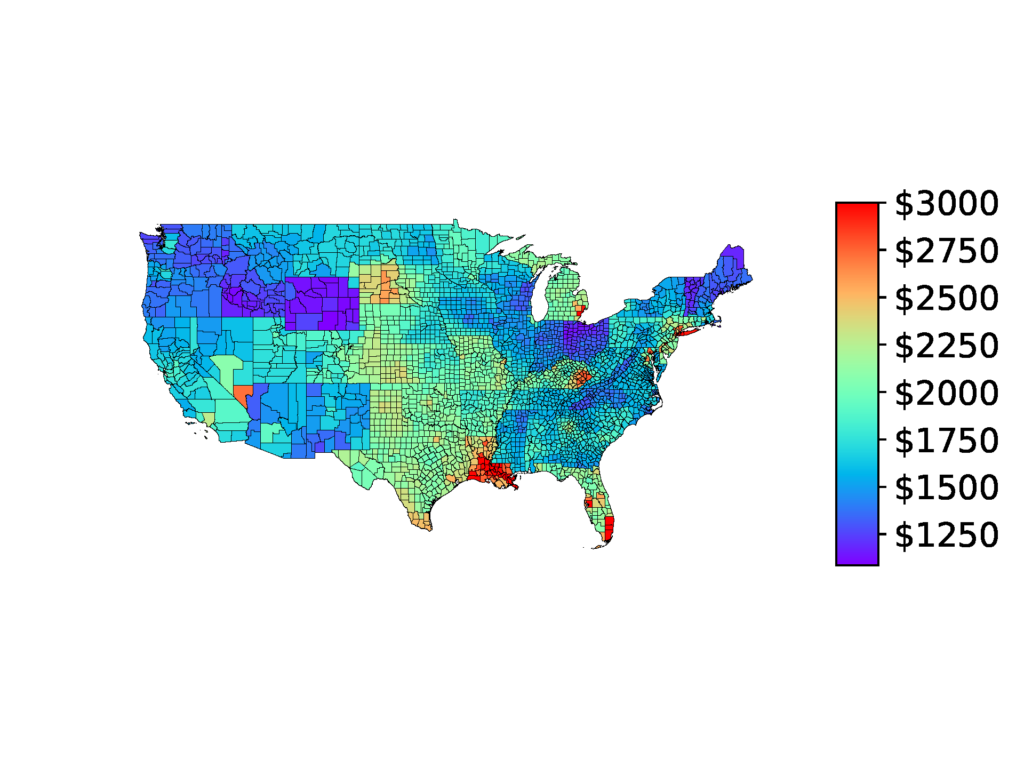

Car insurance rates vary by state. Each state has unique auto insurance laws that determine the type and amount of coverage drivers are required to carry. This means the price you would pay for car insurance in Florida may be very different than the price you would pay for a similar policy in New York due to state regulations.

Additionally, if you live in a state that has a higher number of claims than others, you may pay more for car insurance. For example, if you live in a northern state that gets frequent snowstorms in the winter, you’ll likely pay more for auto insurance since the risk of an accident is higher.

These are the average rates for a full coverage car insurance policy in each state.

| State | Average Annual Premium |

|---|---|

| Alabama | 1,664 |

| Alaska | 1,554 |

| Arizona | 1,778 |

| Arkansas | 1,892 |

| California | 1,856 |

| Colorado | 2,098 |

| Connecticut | 2,120 |

| Delaware | 2,418 |

| Florida | 2,509 |

| Georgia | 1,884 |

| Hawaii | 1,282 |

| Idaho | 1,240 |

| Illinois | 1,845 |

| Indiana | 1,502 |

| Iowa | 1,561 |

| Kansas | 1,963 |

| Kentucky | 2,170 |

| Louisiana | 3,040 |

| Maine | 1,258 |

| Maryland | 2,338 |

| Massachusetts | 1,632 |

| Michigan | 2,675 |

| Minnesota | 1,886 |

| Mississippi | 1,541 |

| Missouri | 2,262 |

| Montana | 1,561 |

| Nebraska | 1,778 |

| Nevada | 2,349 |

| New Hampshire | 1,421 |

| New Jersey | 2,380 |

| New Mexico | 1,596 |

| New York | 3,646 |

| North Carolina | 1,511 |

| North Dakota | 1,609 |

| Ohio | 1,334 |

| Oklahoma | 2,181 |

| Oregon | 1,637 |

| Pennsylvania | 1,996 |

| Rhode Island | 2,055 |

| South Carolina | 1,659 |

| South Dakota | 1,994 |

| Tennessee | 1,695 |

| Texas | 2,167 |

| Utah | 1,831 |

| Vermont | 1,177 |

| Virginia | 1,733 |

| Washington | 1,557 |

| Washington DC | 2,023 |

| West Virginia | 1,594 |

| Wisconsin | 1,459 |

| Wyoming | 1,111 |

The above rates are based on a single 35-year-old male driving a 2023 RAV4. Your rates will vary based on factors such as your age, driving record, and vehicle.

Your zip code also influences what you’ll pay for coverage. Within a state, population density, crime rate, the number of reported accidents, and several other factors can impact the price residents pay for car insurance in a specific zip code.

The national average cost of car insurance is $2,049 per year. This varies from state to state and even zip code to zip code. Currently, Wyoming is the cheapest state to insure a car with an average annual premium of $1,110 a year.

On the opposite end of the spectrum with an average annual premium of $3,646 a year is New York, the most expensive state for car insurance. It’s followed closely by Louisiana, Florida, and Michigan.

No phone or email required

"*" indicates required fields

30 Seconds | No Sign-Up | Reliable Results

It’s important to understand your state’s car insurance requirements and regulations. Knowing the minimum coverage required where you live can give you a good idea of how much your car insurance will cost and will help you choose the right insurance policy.

Almost all states require liability insurance, which helps you pay for expenses related to an accident you cause (or, in other words, are liable for). Usually, states have requirements for both bodily injury liability, which covers the other driver’s medical expenses, and property liability, which covers damages to the other person’s vehicle and personal property. However, the minimum limits for each of these policies differs state-by-state, and some states require more coverage beyond liability insurance.

Find your state to see its required coverage types and minimum coverage amounts. This should give you a good starting point when determining what and how much car insurance you need.

Keep in mind that these numbers reflect state minimum requirements, and you may need more coverage than the minimum requirements based on your needs and desired coverage, which can vary person to person.

The amount of insurance that your state requires is only the starting point for determining what coverage you need. In some cases, you will need or want even more coverage than your state requires. Some of the most common reasons for this include:

Often, people will choose to add more coverage to their policy that covers damages to their own property and events outside your control like theft or weather damage.

Sometimes, it’s a good idea to raise your limits so you don’t get caught paying out of pocket for an expensive accident.

If you lease or finance your vehicle, your lender may have their own requirements for the kind and amount of car insurance you have, like collision or comprehensive insurance.

Rate Retriever rates are based on public rate filings obtained by analytics company First Interpreter. This data comes from the rating plans insurance carriers submit to each state’s department of insurance. Rating plans detail how each carrier calculates premiums using factors such as location, age, gender, and driving record, and they ensure that insurance premiums are both fair and competitive.

For the data on this page, we made the following assumptions: a single male with a clean driving record and Good credit score, driving a 2023 RAV4. We adjusted this profile by age to determine the rates you see on this page.

These rates are not actual quotes and should be used only for comparative purposes. Your rates can vary significantly based on your unique driver profile.

Dig up the best insurance providers in seconds

"*" indicates required fields

Copyright © Rate Retriever Insurance Services LLC, a wholly-owned subsidiary of Soleo Communications, Inc. 2024. All Rights Reserved. Use of Rate Retriever’s services is subject to our Privacy Policy, Disclaimer, and Terms and Conditions. Accessibility statement. Cookie policy.