Call a licensed agent: 833-964-9663

Call a licensed agent: 833-964-9663

Renters insurance covers many of the most common risks that renters can face. In the event of a covered loss, your renters insurance policy will provide compensation for you and your personal property.

Renters insurance is a type of property and casualty insurance that covers renters and their personal property. If you experience a covered loss, your renters insurance policy will provide compensation, based on the terms of your insurance contract. Renters insurance isn’t legally required, but some landlords require tenants to carry insurance.

Read our spam-free promise

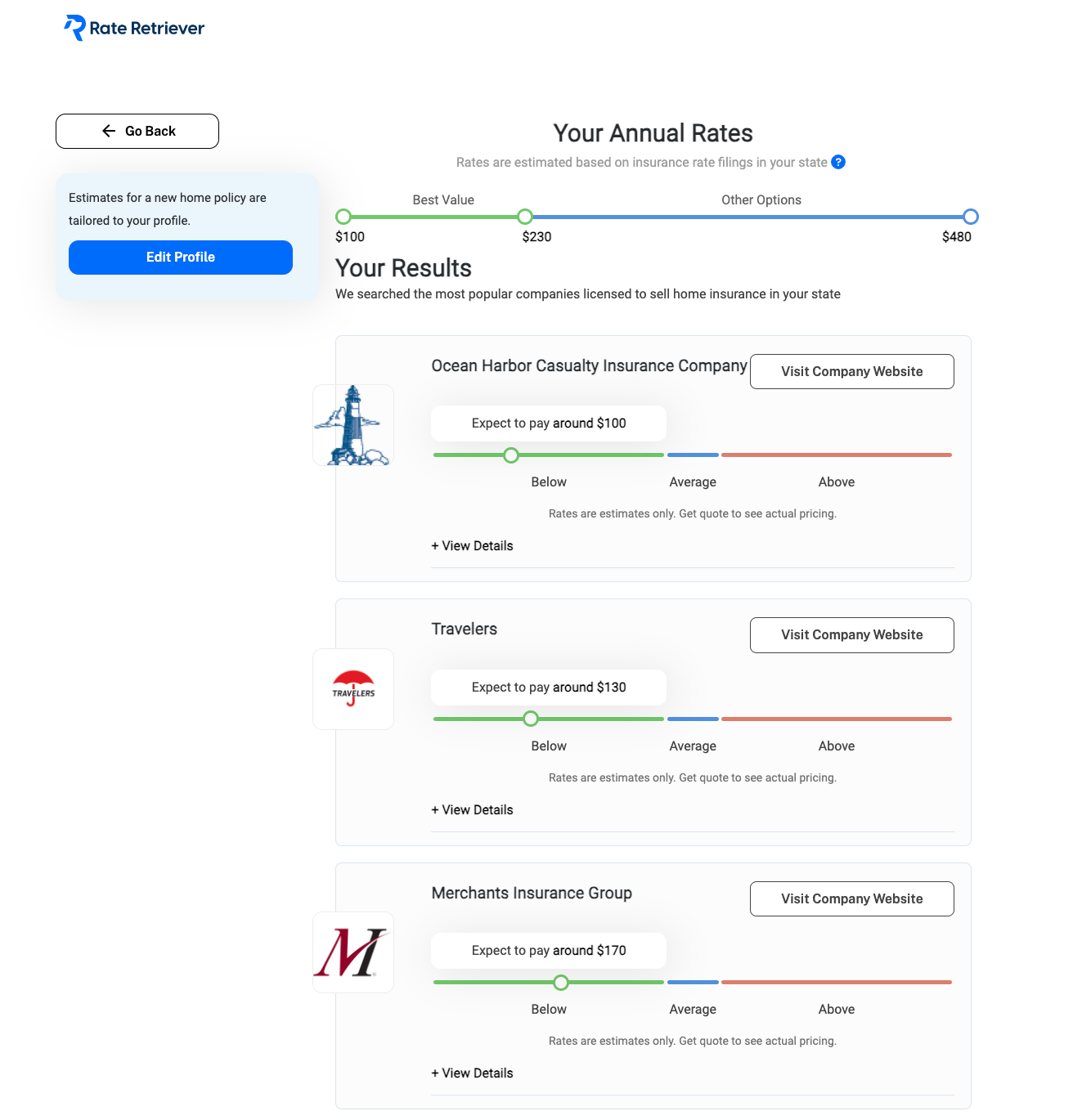

Based on your answers to our short quiz, we’ll estimate how much your renters insurance will cost at each of the top providers near you, so you can find the coverage you need at a price you can afford.

Save time by comparing all your options in one place

We don’t require your phone number or email to see your results

Personalized rate estimates calculated using the insurance company’s rating plan (plus any applicable discounts)

Our rates are based on public rate filings obtained by analytics company First Interpreter. While we may partner with some of the carriers you see on our site, we maintain editorial independence and it does not affect the rates you see. Read more about our rating methodology or see our rigorous editorial policy.

All renters insurance policies cover your personal belongings against specific losses, like theft and natural disasters. Pretty much everything you own is covered, including furniture, clothing, small appliances, home decor, and electronics. Valuable items, like jewelry and collectibles, are usually covered at a much lower policy limit.

Renters

insurance will cover your items inside your apartment and anywhere in the

world, including in your vehicle.

Personal liability insurance covers your legal and financial responsibilities in the event of a third-party bodily injury or property damage claim. It pays for a settlement with the other person, as well as your legal fees and court costs. So, for example, if your dog bit the mail carrier and they sued you for their medical bills, the liability portion of your renters insurance policy would likely cover the costs.

Medical payments insurance provides coverage for a guest’s medical bills if they get injured in your apartment. This coverage applies even if you weren’t responsible for the accident. However, medical payments insurance typically provides a small amount of coverage, and most policies don’t provide enough coverage to replace a health insurance policy, for instance. Also, medical payments insurance doesn’t cover your own injuries if you get hurt at home.

Loss of use insurance pays for temporary living expenses if your apartment gets damaged in a covered loss, and you have to relocate while repairs are made. This policy typically covers things like a hotel, restaurant meals, parking, and laundry. Most policies have a monetary limit for loss of use benefits, so you may still need to be mindful of your spending.

Basic renters insurance policies provide robust coverage. However, there are various losses that aren’t covered. Here are some of the things that renters insurance usually doesn’t cover:

For more protection, many renters insurance companies sell endorsements, which fill gaps in your policy. For example, if you live in a flood-prone area, you might add flood insurance or water backup coverage. If you live in an area that experiences earthquakes, getting earthquake insurance can also be valuable.

Legally speaking, you probably aren’t required to have renters insurance. However, some landlords require tenants to have renters insurance as part of their lease agreement.

Even if renters insurance isn’t required, it’s still a good thing to have. Your landlord’s insurance policy won’t cover your personal belongings, even if the building gets destroyed. And if you find yourself caught up in a liability claim, you would have to pay out-of-pocket for your legal bills if you didn’t have renters insurance.

Not only does renters insurance provide peace of mind and financial protection, but it’s very affordable. According to the Insurance Information Institute, the average cost of renters insurance is just $173 per year, or about $14 per month. To compare, the average cost of homeowners insurance is much more expensive, at $1,311 per year.

Everyone needs a different amount of renters insurance. As a general rule, you should have enough personal property insurance to cover the total cost of the items you own. If you’re not sure how much coverage you need, it can be helpful to create a home inventory.

For liability insurance, you should choose coverage limits that cover the full value of your assets, like a vehicle, money in savings, retirement accounts, and investments. If you were sued for bodily injury or property damage, these are the assets that would be at risk if you didn’t have enough insurance coverage to compensate the other person for their losses.

There’s no set guideline for choosing coverage limits for medical payments or loss of use insurance. However, most insurance companies offer a few different coverage limits, so you can choose the amount of protection you want. Keep in mind that choosing higher coverage limits usually means you will pay a higher premium.

There are lots of insurance companies that sell renters insurance. The best renters insurance company is different for everyone based on your location, coverage needs, budget, and other personal factors. To find the best renters insurance provider, you should compare a few insurers and get quotes to find the most affordable policy.

When comparing renters insurance companies, here are some criteria you should consider:

Check to see what coverage limits the insurance company offers and make sure they offer sufficient policy limits for your needs.

Many renters insurance companies offer discounts, but some offer more savings opportunities than others.

Look at the company’s third-party ratings from J.D. Power, AM Best, and the National Association of Insurance Commissioners (NAIC).

Read customer reviews and testimonials to see what current and past customers think of the company.

Before you purchase renters insurance, make sure to get quotes from a few different companies, which will help you find the cheapest policy for your situation. You can take our short quiz to see how much you can expect to pay for renters insurance.

Compare personalized rate estimates from the top insurance companies in your state

Quick | Private | Reliable

"*" indicates required fields

Yes, renters insurance does cover theft of personal items in your home and when you’re on vacation. It also covers items in your vehicle. If your car gets stolen, your renters insurance policy would pay to replace the items inside.

Renters insurance isn’t usually required, but some landlords require their tenants to have renters insurance. Check your lease agreement to see if your landlord requires your to have renters insurance. Even if renters insurance isn’t required, it’s still beneficial. It’s also one of the most affordable types of insurance you can get.

Renters insurance policies usually cover water damage that is sudden and accidental. For example, if a pipe bursts under your sink and leaks into the bathroom, the damage would likely be covered. However, renters insurance doesn’t cover water damage from flooding or water damage that is gradual, like a leak you never fixed.

Renters insurance is worth it for most people. It provides valuable protection for your personal items and your personal liability, and the coverage is usually pretty cheap. Renters insurance also provides peace of mind in case something unexpected happens, like a natural disaster, and you need to temporarily relocate while your apartment is fixed.

Dig up the best insurance providers in seconds

"*" indicates required fields

Copyright © Rate Retriever Insurance Services LLC, a wholly-owned subsidiary of Soleo Communications, Inc. 2024. All Rights Reserved. Use of Rate Retriever’s services is subject to our Privacy Policy, Disclaimer, and Terms and Conditions. Accessibility statement. Cookie policy. Do Not Sell My Personal Info.