Call a licensed agent: 833-964-9663

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

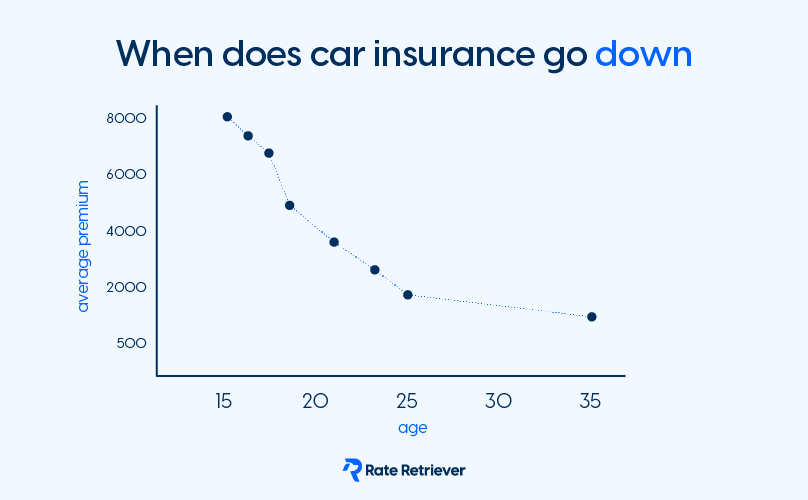

According to Rate Retriever’s Quarterly Insurance Rates Update, teen drivers pay an average of $7,401 a year for their car insurance, $5,577 more than the national average of $1,824. Teen driver rates are higher because of their limited experience behind the wheel, but when can young drivers expect this number to go down?

Typically, drivers will see a decrease in their car insurance rates when they reach their mid-twenties. On average, drivers experience a $5,215 total decrease in car insurance costs from age 17 to age 25. However, age is just one factor that impacts your car insurance costs, factors such as location, credit score, and the make and model of your car are also considered in setting rates.

By age 25, car insurance companies no longer consider you to be an inexperienced driver. Since it has been shown that the likelihood of an accident decreases each year from age 17 to 25, car insurance rates follow the same pattern.

Remember, car insurance prices look different for every driver depending on several different factors. While age is important, it is not the only risk factor that insurance companies consider – factors such as your driving record will likely play a larger role in how much you will pay for car insurance, even after hitting your mid-twenties.

Additionally, each car insurance company has their own unique rating system, so it can be tricky to know which one offers the lowest rates for each individual. Our quick quiz can help you compare rates from several different insurance companies and find savings in 30 seconds.

Beyond selecting the right company, there are other steps you can take to keep your car insurance costs low. First, the amount of coverage you purchase will significantly impact your rate. Depending on the state you live in, the minimum requirements for car insurance will vary. Learning what your state mandates and making sure you only have the coverage you need is one way to save money on car insurance—even as a young driver.

Another method to consider is a pay-per-mile policy. Numerous car insurance companies such as Allstate and Nationwide offer this for drivers who only want to pay insurance for the miles they drive. This may be a cost-effective option if you drive a minimal number of miles each month.

The car you drive also has an impact on your car insurance costs. Typically, vehicles with high safety ratings and a low cost of repair and replacement parts will have lower car insurance rates. According to Rate Retriever’s research, the cheapest car to insure among popular 2023 models is the Subaru Outback. The average annual premium for this car is $1,737, 18% cheaper than the average 2023 vehicle premium.

If you are a young driver in the market for a new car, consider the cost of insurance before making your purchase.

Car insurance companies determine how much they charge you based on your driver profile. Factors that can impact your rates include:

Read more about the factors that impact your car insurance rate

Switching your car insurance is easy, even if you are in the middle of your current policy.

Here are some helpful tips to consider to switch your car insurance:

The answer to this question depends on where you live and what you would like to cover.

Each state has its own minimum requirements on the type and amount of insurance needed. When you’re trying to determine what and how much car insurance you need, you can start by reviewing your state’s requirements.

Find out what’s required in your state

Once you review your state’s minimum requirements, you may find that you want additional coverage. For example, sometimes owners of new cars want comprehensive coverage to insure their car from natural disasters and vandalism, even though comprehensive coverage isn’t required by their state. To figure out what insurance you want, you can review the different types of insurance to decide what makes the most sense for your situation.

The biggest difference between Rate Retriever and other comparison sites is that we are a free and impartial research tool NOT an insurance marketplace. This means you can’t purchase a policy directly through RateRetriever.com, but you can use our tool to independently research your options and seamlessly connect with the provider you choose.

Unlike other insurance comparison sites, we:

We like to think that Rate Retriever is your insurance companion, not just another insurance comparison site. Our values guide everything we do, which is why we strive to offer transparent, trustworthy insurance tools.

There are many ways you can try to get cheaper car insurance. The first is simply to get quotes from multiple providers. This will help you determine if you’re currently receiving the cheapest rates based on your needs and driver profile. Rate Retriever makes the comparison process easy.

Sometimes, the reason your car insurance is so expensive is due to your driver profile. For example, drivers under 20 years old usually pay more for insurance than more experienced drivers, and drivers with a recent at-fault accident or traffic violation typically pay more.

There are ways to lower the cost of your insurance such as taking a defensive driving course. Check with your provider to see if there are any discounts you qualify for or can reasonably earn.

Rate Retriever works with national and local insurance providers to provide our users with a seamless insurance shopping experience. We may earn a commission from our insurance provider partners when you click on a link, call, or purchase a policy from one of the providers listed on our site. That said, we’re committed to providing you with accurate, bias-free information, and we do not allow our partnerships to limit the results or influence the information we share with you.

We do not sell your personal information, charge you for using our tools, or sell you insurance policies. Additionally, should you choose to purchase a policy from one of our partners, the price you pay will not be adversely affected.