A poor credit score can lead to 76% higher car insurance rates in Texas

Katie Dee

on

2024-01-09

A poor credit score can lead to 76% higher car insurance rates in Texas

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Even within the same state, car insurance rates look different for each individual driver. Rates are determined by factors such as your driving record, your age, the make and model of your car, and more. In Texas, the average yearly cost for car insurance is $1,886, just 3.4% higher than the national average of $1,824. However, some drivers in this state still pay upwards of $3,300 every year for car insurance.

So, how can you be sure you’re getting the best rate possible? First you need to understand what exactly goes into nailing down your specific premium.

Gender and Texas car insurance rates

In the state of Texas, car insurance companies use the gender specified on your license as a rating factor in car insurance. According to Rate Retriever’s Auto Insurance Rates Quarterly Update, on average, female policyholders pay around 3% less for car insurance than their male counterparts, a difference of about $50 per year.

While the use of gender as a rating factor has been prohibited in other states, Texas’s board of insurance still allows the practice, and research shows that female drivers are more risk averse on the road and, therefore, less likely to get into an accident.

Coverage level

The level of car insurance coverage you choose will also have an impact on your rate. Rate Retriever’s research showed that those with a minimum coverage policy can save up to 63% on their car insurance when compared to those with premium coverage. The average annual premium for a minimum coverage policy in Texas is $707 while premium coverage costs around $1,886.

Furthermore, drivers who choose to have a standard coverage policy with slightly lower limits pay an average of 4% less than those with premium coverage. The average premium for standard car insurance coverage in Texas is $1,807 per year.

Credit score

According to Rate Retriever’s report, credit score affects car insurance rates in Texas more than any other rating factor. On average, drivers in the state with poor credit scores pay $3,316 per year for their car insurance. This is an increase of 76% when compared to those with good credit scores who pay $1,886 annually.

Auto insurance companies often look at a policyholder’s credit score to determine how much risk the policy will introduce because research has shown a relationship between a person’s credit score and their likelihood of filing an insurance claim. Because of this, monitoring your credit score is essential when it comes to ensuring you’re not overpaying for car insurance.

How zip code impacts car insurance in Texas

Your exact location within the state of Texas will have a fairly large impact on what you will pay for car insurance. Insurers typically consider factors specific to your zip code such as traffic patterns, crime rates, and car accident rates in order to determine how much risk is associated with a certain policy and then set rates accordingly.

Currently, the most expensive zip code for car insurance in Texas is 75224, located in Dallas, with an average annual premium of $2,399. With an overall population of 1.288 million people and a population density of around 3,400 people per square mile, Dallas is the third most populous city in Texas. In a large metropolitan area like this, car accidents will happen more frequently and so car insurance companies will assign higher rates.

Conversely, the least expensive zip code for Texas car insurance is 76543 in Killeen, with an average annual premium of $1,498. This area has a population of just over 156,000 people, significantly reducing the likelihood of the driver filing a claim and allowing car insurance companies to assign lower rates.

How to lower car insurance rates in Texas

There are several ways you can control your car insurance rates in Texas. The first is to shop around and compare rates from multiple different insurance companies in your area to ensure that you are getting the best one. Rate Retriever’s short quiz can help you get started and find savings in 30 seconds.

Additionally improving your credit score, maintaining a good driving record, and seeking out discounts you could be eligible for are great ways to save money on car insurance in Texas.

Frequently asked

How does the insurance company determine my rate?

Car insurance companies determine how much they charge you based on your driver profile. Factors that can impact your rates include:

- Demographics – your age, home ownership, credit score, and more

- Your driving history – how long you’ve been driving, traffic violations, and more

- Your car – make, model, and year

- Where you live – state and zip code

- How much coverage you want

Read more about the factors that impact your car insurance rate

How do I switch my car insurance?

Switching your car insurance is easy, even if you are in the middle of your current policy.

Here are some helpful tips to consider to switch your car insurance:

- Decide what coverage you want with your next policy

- Check if your current provider charges cancellation penalties or fees

- Compare prices from at least 3-5 insurance companies (Rate Retriever makes this easy, giving you personalized rates from the top companies near you)

- Get a final quote from at least one of your choices

- Cancel your current policy once your new one begins

How much car insurance do I need?

The answer to this question depends on where you live and what you would like to cover.

Each state has its own minimum requirements on the type and amount of insurance needed. When you’re trying to determine what and how much car insurance you need, you can start by reviewing your state’s requirements.

Find out what’s required in your state

Once you review your state’s minimum requirements, you may find that you want additional coverage. For example, sometimes owners of new cars want comprehensive coverage to insure their car from natural disasters and vandalism, even though comprehensive coverage isn’t required by their state. To figure out what insurance you want, you can review the different types of insurance to decide what makes the most sense for your situation.

How is Rate Retriever different than other insurance websites?

The biggest difference between Rate Retriever and other comparison sites is that we are a free and impartial research tool NOT an insurance marketplace. This means you can’t purchase a policy directly through RateRetriever.com, but you can use our tool to independently research your options and seamlessly connect with the provider you choose.

Unlike other insurance comparison sites, we:

- Use third-party data to give you more accurate rate estimates instead of inaccurate, suspiciously low quotes to get you in the door

- Do not limit your list of results to paid advertisers

- Do not collect your email or phone number before we let you see your results

- Give you results after just five questions (however, your results will be more accurate if you complete your profile)

We like to think that Rate Retriever is your insurance companion, not just another insurance comparison site. Our values guide everything we do, which is why we strive to offer transparent, trustworthy insurance tools.

How can I get cheaper car insurance?

There are many ways you can try to get cheaper car insurance. The first is simply to get quotes from multiple providers. This will help you determine if you’re currently receiving the cheapest rates based on your needs and driver profile. Rate Retriever makes the comparison process easy.

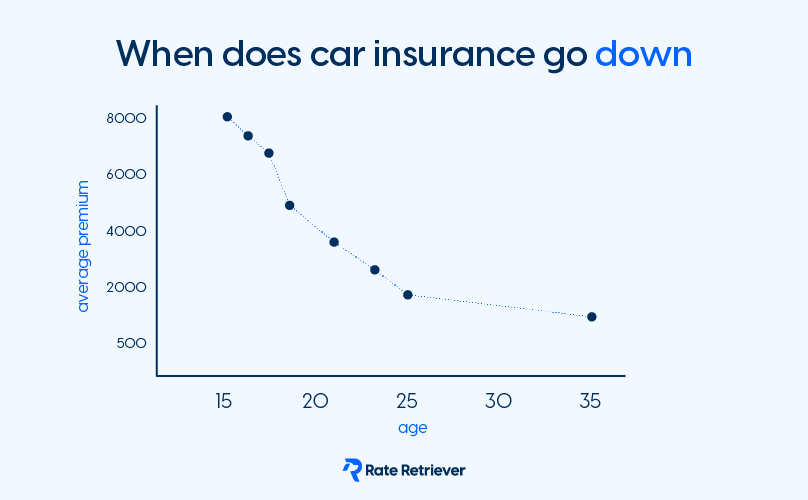

Sometimes, the reason your car insurance is so expensive is due to your driver profile. For example, drivers under 20 years old usually pay more for insurance than more experienced drivers, and drivers with a recent at-fault accident or traffic violation typically pay more.

There are ways to lower the cost of your insurance such as taking a defensive driving course. Check with your provider to see if there are any discounts you qualify for or can reasonably earn.

How does Rate Retriever make money?

Rate Retriever works with national and local insurance providers to provide our users with a seamless insurance shopping experience. We may earn a commission from our insurance provider partners when you click on a link, call, or purchase a policy from one of the providers listed on our site. That said, we’re committed to providing you with accurate, bias-free information, and we do not allow our partnerships to limit the results or influence the information we share with you.

We do not sell your personal information, charge you for using our tools, or sell you insurance policies. Additionally, should you choose to purchase a policy from one of our partners, the price you pay will not be adversely affected.